Tow trucks are essential for providing roadside assistance and recovery services, yet their prices can vary significantly by type, size, and capabilities. With the growing number of vehicles on the road, understanding the cost of tow trucks has never been more crucial for everyday drivers, auto repair shops, property managers, and truck owners. This article delves into various aspects of tow truck pricing, including the costs of new and used models, commercial heavy-duty vehicles, and additional expenses that may arise. Each chapter explores these factors, ensuring that readers are properly informed about both the initial investment and the long-term ownership costs associated with tow trucks.

Tow Truck Price Realities: What Drives the Cost of New Recovery Machines

In the fleet world, price is more than a number. It’s a reflection of capability, reliability, and the unique demands of the roads it will work. A tow truck is not just a vehicle; it’s a mobile workshop, a rescue tool, and a gateway to rapid incident response. The price tag you see on the lot or in a catalog is the tip of a larger iceberg. Size, lifting capacity, drivetrain configuration, and the precise mix of recovery features dictate the range you will observe in the market today.

Light-duty flatbeds sit at the low end of the spectrum. For smaller operations focused on car-to-car or light-vehicle service, basic flatbeds can begin around the mid-teens to low teens in thousands. Real-world entries often sit near twelve thousand eight hundred dollars for compact 2–4 ton units. Those figures are not just numbers; they signal what you can expect in equipment quality, standardization, and warranty. When a shop sees a price in that region, they are typically looking at essential functionality: a rigid bed, a proven wheel-lift or basic hoist, standard lighting, and standard safety features. The tradeoff is straightforward: fewer advanced features, simplified electronics, and less payload range. Still, for many independent operators or roadside assistance fleets, a basic flatbed is the practical starting point because it covers a high percentage of routine vehicle recoveries without overcommitment.

As needs grow, the price ladder climbs quickly. Mid-range flatbeds and wheel-lift configurations push comfortably into the thirty-five thousand to seventy-five thousand dollar zone. These models bring stronger lifting capacity, longer reach, quicker winches, and more robust chassis and hydraulics. The boom is beefier, the safety gear scales up, and the electronics for monitoring, diagnostics, and coordination become more sophisticated. For a towing company facing higher utilization, a mid-range unit promises fewer unplanned downtime events and more uptime in demanding shifts. It is not merely more metal; it is better control over time, speed, and the certainty that a repair will stay intact under difficult loads.

The most dramatic price jumps occur when a shop invests in rotators and heavy-duty hybrids designed for complex recoveries, overturned vehicles, and emergency response. A top-tier rotator, with a 360° rotating boom and extended hydraulic reach, can run well into six figures—often between one hundred fifty thousand and three hundred thousand dollars or more. The justification rests on advanced hydraulics, sturdier chassis, longer booms capable of swinging into awkward positions, and the ability to handle unprecedented loads with rapid, controlled precision. For municipal fleets, airline hangar operations, or disaster-response teams, the rotator’s cost is balanced by the speed, safety, and versatility it delivers in the worst conditions. For commercial operators, the decision hinges on anticipated frequency of complex recoveries and the cost of delay if a simple unit cannot perform a critical job.

Within the broader market, there are concrete, regionally influenced examples that anchor these ranges in real numbers. A newly configured heavy recovery setup such as a Sinotruck HOWO 6X4 10-wheel, 25-ton road wrecker demonstrates how a well-specified heavy vehicle can sit in a mid-range price band for heavy-duty operations. In many markets today, such a machine stamps in around thirty-two thousand to thirty-five thousand dollars when configured for standard compliance with institutions like ISO-9000, CCC, CE, and RoHS. It is a pragmatic choice for a fleet that expects to service large, stationary, or multi-axle recoveries, where reliability and regulatory alignment matter as much as raw pulling power. On the other end of the spectrum, a factory-price rescue tow flatbed wrecker with crane offers a surprising breadth of options. Depending on the configuration, winch capacity, and whether a crane is integrated, prices can range from roughly twelve thousand eight hundred up to about thirty-nine thousand eight hundred dollars. For buyers, that spread underscores how much customization matters—and how choices like crane reach, crane load rating, and winch speed reshape the bottom line.

Even within the new market, the possibility of stepping slightly down from the top tier but still investing in significant capability exists in what some manufacturers offer as light-medium duty recovery trucks. The price pressure in this vertical means that buyers must carefully map their operational profile to the machine’s design. A few key questions shape this mapping: How often will you operate in congested urban settings versus wide-open rural roads? What weights and axle configurations are most common on the fleet? Will you encounter off-road conditions or challenging terrains that demand more rugged suspensions and higher ground clearance? The answers determine whether a purchase sits at a lower mid-range or climbs toward the higher end of the spectrum. In practice, many operators encounter a tendency to over-invest in capabilities they do not fully utilize, and yet under-invest in the aspects they do need, such as reliability and after-sales support.

For those who want a more granular sense of market entries, larger recovery trucks may command prices in the roughly twenty thousand to thirty-three thousand bracket, not unlike the larger Sinotruk or similar models when they arrive in a particular configuration. Reports from the industry highlight that a robust 340 horsepower diesel engine, capable of handling roughly twenty to thirty tons, can fall into the twenty-thousandish to thirty-thousand-dollar territory for factory pricing, depending on the exact drivetrain, the cabin specification, and the regional tax and freight structure. That may sound modest compared with flashier rotators, yet it reflects a powerful balance of capacity and cost, suited to mid-to-large fleets that prioritize weight capacity and reliability without the most elaborate recovery tooling. Even within this band, the options proliferate quickly as you begin to add features like enhanced electronic stability control, more sophisticated winching, dual battery configurations, and extended service contracts that ensure uptime and extend preventative maintenance.

Smaller, more nimble machines—think 3-ton or 5-ton mini recovery vehicles—clock in near the upper twenty-thousands, usually around twenty-one to twenty-two thousand dollars per unit before any regional additions. This category can be a compelling choice for shops with a specific niche: light urban tow, parking-lot recovery, or quick on-ramp assistance where the vehicle must traverse tight spaces and parked vehicles without multiple crew members. The trade-off is clear: lighter loads, shorter reach, less torque, and a more compact garage footprint. It is easy to underestimate these machines’ value when the next job looks like a heavy lift, but in many markets, the efficiency gains from a well-matched mini-recovery unit translate into faster service times and lower maintenance costs per incident.

As a buyer weighs these options, the hidden costs must come into view. A fair purchase price is just the opening line of the ledger. The equipment package—winches, wheel lifts, towing dollies, axle pads, and the safety gear that fleets keep on hand—adds a meaningful premium to the sticker price. The value of safety and communication systems cannot be overstated: proper lighting, sirens, GPS tracking, and fleet-management software are not discretionary luxuries but operational necessities in many jurisdictions. The absence of reliable dispatch, route optimization, and regulatory compliance tracking can add risk and expense far beyond the equipment envelope. Maintenance and fuel constitute ongoing expenditures that escalate with size and duty cycle. A heavy-duty machine consumes more fuel and requires more frequent service visits, sometimes under extended service contracts that ensure uptime but bind the operation into a longer payment horizon. In short, a new truck is never a single purchase; it is a long-term financial instrument that requires careful budgeting for depreciation, maintenance, and eventual replacement cycles.

Given the diversity of configurations and regional factors, prospective buyers benefit from a disciplined approach to budgeting. Start by mapping the typical job profile: average weight of towed loads, frequency of complex recoveries, and expected drive distances. Then demand a detailed cost breakdown from suppliers: base price plus each option, freight, installation charges if any, and after-sales terms. A helpful rule of thumb is to seek a clear separation between the base vehicle price and the add-ons, so you can see how much each feature contributes to the total. This is especially relevant for a “hook and roll” service model where base fees combine with per-mile rates, potentially inflating the final cost in rural areas or during peak hours. The goal is transparency so that price comparisons reflect the same scope across suppliers.

For operators who want a succinct benchmark as they shop, the chapter suggests a simple working range that aligns with the documented market realities. Light-duty flatbeds start near the low tens of thousands, while mid-range configurations lie in the mid to high five-figures. Heavy-duty rotators and specialized recovery systems can exceed the six-figure mark, depending on features and the breadth of the recovery toolkit. If you are preparing to buy, a useful first step is to outline your minimum viable capabilities—the maximum weight you anticipate, the kinds of terrain you expect, and the required reach. From there, you can compare models not solely by price but by the value of uptime, safety features, and the speed with which a machine can respond to incidents. That last factor—responsiveness—often justifies the premium for units designed to operate under pressure, where every minute saved translates into reduced liability, faster clearance, and better customer outcomes.

For readers seeking a direct line into the market, a starting point for many buyers is to examine broader price bands and the precise features included at each level. A practical approach is to compare a basic 2–4 ton flatbed with a 25-ton recovery option, or to contrast a simple wheel-lift layout with a compact rotator’s capability. You can visit the supplier pages for official price quotes and specifications, and, if you want a quick baseline sense of market pricing, refer to the linked resource for a practical snapshot. How much is a tow truck?

Beyond the numbers, one more observation matters: regional freight and import duties can shift prices by a meaningful margin. A truck purchased in one country may reach a different door price after customs, shipping, and local tax. Given that, buyers should request a detailed breakdown of delivery charges and any required local adaptations. The most prudent purchase plan includes a clause for post-purchase support: access to spare parts, trained technicians, and a warranty window that aligns with the truck’s expected duty cycle. In the end, the price spectrum described here is a reflection of a market that rewards reliability, speed, and versatility—the ability to dispatch a well-maintained unit to the scene with minimal delay.

For those who want to explore the global context and confirm the range of factory prices, the research results point to a credible example of a larger recovery profile in the twenty-thousand-to-thirty-three-thousand bracket, depending on configuration. These numbers are not universal baselines but snapshots of cost levels you may encounter as you refine a spec sheet and negotiate with suppliers. The practical implication is straightforward: if you anticipate frequent heavy recoveries, investing in a higher-capacity mid-range or rotating unit may pay off, whereas a light-duty setup keeps amortization and operational risk lower.

As the discussion broadens to the topic of total cost of ownership, it is essential to acknowledge the role of ongoing expenses. Fuel economy scales with vehicle size and duty cycle. Routine maintenance becomes more intensive as the lifting equipment ages, and the procurement of spare parts grows more complex for specialized configurations. Training for operators and maintenance staff, a frequently overlooked line item, contributes to safer operation and fewer downtime events. Fleet management systems, when integrated, help optimize dispatch, maintenance scheduling, and compliance reporting. The cumulative impact of these elements means that the cheapest upfront price does not always deliver the best value over the vehicle’s life. A well-chosen new tow truck can deliver greater uptime, lower salvage costs, and higher customer satisfaction, which translate into steady revenue streams that justify the initial investment.

The bookends of the price spectrum—entry-level light-duty and premium rotators—frame the practical decision for most buyers. The decision should hinge on the frequency of use and the typical job mix rather than a single extraordinary incident. For a small operator who sees a handful of tows per week in urban space, a compact flatbed may suffice and offer the lowest total cost of ownership. A midsized fleet that handles a mix of roadside assistance and accident recovery can strike a balance with a mid-range model, where capability and efficiency reduce per-tow costs. Large fleets with regular heavy recoveries will justify, and in some cases require, the rotator’s dramatic capabilities, given the time savings and risk reduction during critical operations.

If you seek a concise external reference to corroborate the broader market snapshot, a representative industry source highlights the range of costs in a real-world context and provides a practical sense of the configuration options available to buyers. The external resource helps anchor the numbers in a documented pricing environment and can serve as a starting point for deeper vendor conversations. Access the external link for further detail: https://www.made-in-china.com/products/719288735-20600-33600-Towing-Truck.html

null

null

Used Tow Trucks: Real Purchase Prices and the Hidden Costs of Ownership

Used Tow Trucks: Real Purchase Prices and the Hidden Costs of Ownership

Buying a used tow truck can feel like striking a balance between opportunity and risk. The headline numbers—tens of thousands of dollars—are simple enough. The meaningful decision, however, depends on understanding what those numbers represent, what they omit, and how the vehicle will perform in day-to-day work once it’s in your yard. A realistic picture includes sticker prices, mechanical condition, equipment, regulatory compliance, and the inevitable running costs that follow the purchase.

Start with price bands. In the current market, used tow trucks most commonly sell between roughly $15,000 and $60,000. Units at the lower end are typically older, cosmetically worn, and may need immediate mechanical attention. Mid-range purchases, which many small operators choose, often sit between $28,500 and $60,000. These tend to be recent-model flatbeds or wheel-lift trucks with moderate mileage and service history. Higher-priced used trucks—over $60,000—are either heavy-duty machines, rotators, or well-maintained low-mileage rigs that still have significant service life left.

A concrete example seen on international marketplaces is a diesel-powered, 3-ton flatbed from a Japanese manufacturer priced around $28,500–$29,200. That gives a realistic baseline for a capable, mid-sized used flatbed that balances purchase affordability with long-term utility. But this single number shouldn’t be the end of your thinking; it’s the start.

Several factors explain why two seemingly identical trucks can differ in price by tens of thousands of dollars. Age and mileage are obvious. A newer chassis with modest miles is worth more. But so too is service history; a truck with documented, scheduled maintenance is far more attractive than one with gaps. Configuration matters: flatbeds generally fetch different prices than wheel-lift units, and rotators cost substantially more. Winch capacity, hydraulic condition, boom length, and additional accessories (underlift kits, secondary winches, outriggers) add significant value. Finally, regional demand and supply affect the market: urban areas might see higher prices because turnover is faster, while rural listings might be cheaper but involve long-distance delivery costs.

Equipment and certification are another cost vector. A truck that arrives with a recent inspection, a strong winch system, and properly functioning lights and controls will be worth a premium. Conversely, trucks missing safety gear, lacking required lighting packages, or with faulty hydraulics will need investment before they can be put to work. Factor in the cost of replacing worn straps, chains, or winch cables, as well as the price to service braking systems and the transmission if those components show wear. Some buyers underestimate how quickly a relatively inexpensive used truck can accrue repair bills.

Hidden costs can eclipse the purchase price if not anticipated. Shipping and import fees matter when buying from out-of-region or international sellers. Taxes, title transfers, and registration fees vary widely by jurisdiction and sometimes require unexpected inspections. Insurance for a tow truck is typically more expensive than for a standard pickup, reflecting the risk profile of towing and roadside operations. Licensing and permits also add costs: some locales require specialized vehicle inspections or operator certifications to run a commercial towing vehicle.

Fuel and maintenance are ongoing expenses that increase with vehicle size. Light-duty flatbeds may be relatively economical, but older diesel engines can be thirsty. Heavy-duty and older chassis often need more frequent servicing and costlier parts. Budget for a maintenance reserve fund equal to several percent of the purchase price annually; this helps smooth out the inevitable repairs that come with older equipment.

Buying strategy influences long-term value. Purchasing through a reputable dealer may cost more up front but often reduces risk through certified inspections, limited warranties, or pre-sale servicing. Private sellers can offer lower prices, but they shift inspection responsibility to you. Auctions offer bargains, yet they bring the highest uncertainty: you rarely get a full mechanical history, and many auctioned trucks sell as-is. When considering financing, compare interest rates and loan terms; older used trucks sometimes carry higher rates or shorter amortization periods.

An effective inspection checklist reduces surprises. Start with a full walkaround: look for structural rust on frame rails, weld repairs around the deck or boom, and any signs of previous collision damage. Test hydraulics for smooth, leak-free operation; watch for slow or noisy movement. Verify winch performance under load if possible, and confirm the wheel-lift and towing controls work without binding. Underhood, assess engine oil condition, look for leaks, and note unusual smoke on startup. Check tires for uneven wear, which can signal alignment or suspension issues, and confirm brakes have life left.

A professional mechanical inspection is worth the fee. A certified diesel mechanic or specialist in recovery vehicles can identify problems you might miss. Expect to pay a few hundred dollars for a thorough check; consider it insurance that avoids a major post-purchase bill. Always verify clear title and check for any liens—especially important when buying from auction or less-established sellers.

Negotiation should reflect both visible and latent issues. Use any required repairs or missing equipment as leverage for price reduction. If the truck will need a new hydraulic pump or a deck replacement soon, estimate those costs and subtract them from your offer. In many cases, sellers are willing to negotiate on equipment that costs you time and money to restore to serviceability.

Plan for upfront upgrades and compliance work. Even a well-priced truck may need modern safety lights, updated communications gear, and fleet software installation to match your operation. Installing GPS tracking, dash cameras, and dispatch integrations improves efficiency but adds to the initial spend. Factor these installations into your budget before declaring a purchase a good deal.

Assess expected service life and resale potential. A disciplined buyer thinks in terms of return on investment. How many tows per week will the truck perform? What load types will it encounter? For a busy recovery operator, a slightly higher-priced but newer used truck could provide more uptime and lower repair frequency, delivering better economics. Conversely, for light seasonal use, a low-cost older truck might be sensible.

Finally, consider total cost of ownership rather than purchase price alone. Combine the purchase price with immediate repairs, registration and compliance fees, insurance, shipping, and the first year of maintenance and fuel. This sum gives a clearer picture of what the truck will actually cost to get into service. Compare that total against alternatives: leasing, buying new with warranty, or partnering with a carrier that provides equipment.

For a deeper look into how tow truck pricing fits into broader purchase decisions, see this internal resource on overall towing costs: how much do tow trucks cost.

If you’re exploring international marketplace listings or want to compare current broad-market prices, many buyers begin searches on large commercial platforms where used recovery vehicles are listed. Those platforms will show a range of offers and shipping possibilities, but be sure to verify listings and titles independently. (External resource: https://www.alibaba.com)

A used tow truck can be a highly economical entry into towing, but only when the buyer accounts for mechanical condition, equipment, compliance, and ongoing operating costs. Price ranges provide useful anchors, but the smartest purchases come from rigorous inspections, realistic budgeting for hidden costs, and a purchase strategy aligned with how you plan to use the truck.

Beyond the Sticker Price: Navigating Hidden Fees in Tow Truck Pricing

When people gauge the cost of getting a vehicle towed, they often fixate on a base rate or a rough per-mile figure. Yet the final bill almost always equals more than that starting price. Tow-truck pricing is a layered conversation, composed of the base service and a spectrum of variable charges that rise with timing, vehicle type, recovery difficulty, and ancillary services. Understanding these factors is essential for drivers who want to avoid sticker shock and for operators who aim to price fairly while staying compliant with safety and regulatory requirements. The big lesson is to look for transparency, because the most mispriced jobs are the ones with the least upfront clarity about the additional costs that can accrue before the tow completes.

After-hours and emergency fees illustrate one of the most impactful hidden costs. In many areas, a tow performed outside normal business hours—late at night, on weekends, or during holidays—carries a premium. The operational costs climb because crews are on call, equipment is taxed by longer hours, and dispatch resources are stretched thin. A job that might cost a typical daytime rate can easily double or even triple once the clock has passed midnight. It’s not unusual for companies to disclose these surcharges in service agreements, but they aren’t always presented plainly during the initial call. For a consumer, the challenge is to request a written estimate that clearly itemizes these potential charges before the tow begins. It’s a prudent move to confirm whether after-hours fees apply to the specific time window of the tow and to understand exactly how those fees are calculated—whether they are a flat premium, a percentage of the base rate, or a combination.

The complexity of the recovery operation has a similarly large effect on price. The type of vehicle and the particulars of the scene dictate the level of equipment and labor required. A light-duty passenger car towed with a basic flatbed or wheel-lift may stay near the lower end of the spectrum, especially in straightforward highway recoveries. In contrast, heavier vehicles—such as large SUVs, trucks, or cargo vans—demand more heavy-duty equipment, greater fuel use, and more careful handling. When a scene involves a ditch, a vehicle on its side, or a vehicle that is submerged or partially immobilized, the job may require specialized gear and higher skill levels. In some cases, the dispatcher will call for rotator or boom-equipped units that can recover and upright vehicles with precision. These high-end capabilities come with a premium, reflecting not only the equipment but the expanded crew hours and heightened risk management that accompany such recoveries.

Storage and impound fees are another reality that can surprise the unprepared. If a tow involves a police impound or a private storage facility, the clock on storage starts the moment the vehicle is moved. Daily charges can accumulate quickly, creating a hidden cost that extends the financial footprint well beyond the initial tow. Typical storage rates in many markets fall in a range that can produce hundreds of dollars if a vehicle sits for days while insurance claims are filed or legal issues are resolved. For the vehicle owner, it’s wise to ask for an upfront estimate that includes daily storage costs and to clarify whether storage will be waived or reduced if the vehicle is retrieved promptly. In some cases, a tow operator can offer a time-bound plan or a payment option that helps minimize the surprise of a large storage bill.

Distance and route complexity also shape the final price in meaningful ways. While the distance from scene to destination matters, the actual route can influence fuel consumption and labor time. Rural tows may require longer travel and more fuel, while urban routes can be slowed by traffic, leading to longer man-hours and higher hourly rates. Some operators price by distance brackets, such as 0–10 miles or 10–25 miles, which adds two layers of complexity: precise mileage documentation and potential rate changes if the route veers into a different bracket. Understanding the exact mileage and the route can help customers compare quotes more accurately and avoid base-rate misinterpretations that hide the true cost of the tow.

Beyond the core service, a bundle of optional services and piecewise use of equipment can swell the invoice. Many drivers need a key replacement, a battery jump, fuel delivery, or assistance unlocking a locked vehicle. Each of these tasks is often billed separately, even if they are performed within the same call. The use of specialized devices such as a hydraulic lift, wheel lifts, or a flatbed platform may incur additional fees depending on the company’s policy. While these services can be lifesaving in an emergency, they require careful review before agreeing to the service. The goal is a detailed, itemized estimate that lays out every potential charge up front, enabling customers to decide which services they actually need and which are optional add-ons.

A practical upshot of this pricing reality is the power of a written, itemized estimate. When a tow is imminent, demand a formal breakdown that lists the base rate, all per-mile charges, after-hours surcharges, equipment usage fees, service call fees, and any storage or impound costs. This document should also specify any minimum charges and the expected time on scene, as well as the anticipated duration of the tow, since time can be a factor in the labor rate. For the consumer, this level of detail is not merely helpful; it’s a shield against surprise invoicing and a tool for negotiating fairer terms. For the provider, it is a best practice that reflects professional standards, fosters trust, and reduces disputes after service has been delivered. A well-documented estimate also supports better dispatch planning, particularly for rural or high-demand regions where delays can ripple through the pricing structure.

To navigate these complexities, it helps to approach pricing with a broader perspective that includes the broader market signals about tow-truck costs. The base rate is only one facet of the cost equation. The price landscape is shaped by regional differences, the fleet mix of the operator, and the competitive tension among nearby service providers. A consumer who takes the time to compare quotes, asks for written estimates, and inquires about all potential charges will be far better positioned to avoid misaligned expectations. The same principle applies to businesses evaluating fleet investments. When a shop owner or operations manager assesses purchasing or leasing a tow-truck fleet, the decision should hinge not just on the sticker price of a single unit, but on a comprehensive cost model—including operating costs, maintenance, fuel, insurance, and the potential revenue from a given configuration under typical demand patterns. The experience of many operators suggests that including a realistic set of contingencies in a pricing model yields not only better profit margins but also more predictable cash flow across seasons and different service areas.

For readers seeking practical guidance on pricing and transparency, a closer look at the cost structure is laid out in a dedicated resource that illuminates the nuances of tow-truck pricing. This guide, focused on price breakdowns and decision-making, helps translate the jargon of rate sheets into understandable terms. As you weigh options, consider how the specific circumstances of your vehicle, your location, and your timing influence the final bill. If you want a concise reference that foregrounds the core elements of pricing, you can explore the detailed framework here: https://winchestertowtruck.com/tow-truck-cost-pricing/. In practice, the most reliable approach is to ask for a bottom-line total in writing, then verify that the estimate accounts for all the factors described above. The humility in this approach is that no one knows all the variables with perfect accuracy before a scene is assessed, but a thorough, upfront estimate can narrow the margin of error substantially.

As markets evolve and fleets modernize, the structure of tow-truck pricing continues to reflect both the complexity of vehicle recovery and the realities of service logistics. For customers and operators alike, the message remains clear: do not anchor your expectations to a single price point. Anchor them to a transparent, itemized understanding of what that price covers, how it can change with time and circumstance, and what can be done to manage or mitigate those changes. In the end, it is this shared commitment to clarity and fairness that keeps towing both a reliable service and a fair business practice. External references offer additional context on how pricing is framed across different regions and situations, underscoring the importance of education as the best defense against surprise charges. External reference: https://www.aaacar.com/understanding-tow-truck-pricing/

Pricing at the Crossroads: How Tow Truck Features Shape Cost and Capability

Choosing a tow truck is as much a study in tradeoffs as it is a purchase decision. The sticker price on a showroom model barely scratches the surface of what owning and operating a tow truck will cost over its life. The numbers you encounter in early 2026 reflect a marketplace that rewards specialized capabilities, durable build quality, and smart integration with dispatch and safety systems. When you step back from the advertised price, a clear pattern emerges: cost is driven by decisions about what the vehicle is built to do, how it is built to do it, and how much you plan to rely on it in the most demanding situations. That understanding matters because a small premium today can translate into substantial savings—or unexpected expense—down the road. To navigate this terrain, it helps to think through four core design decisions that dominate price, then connect those decisions to real-world needs and long-term value.

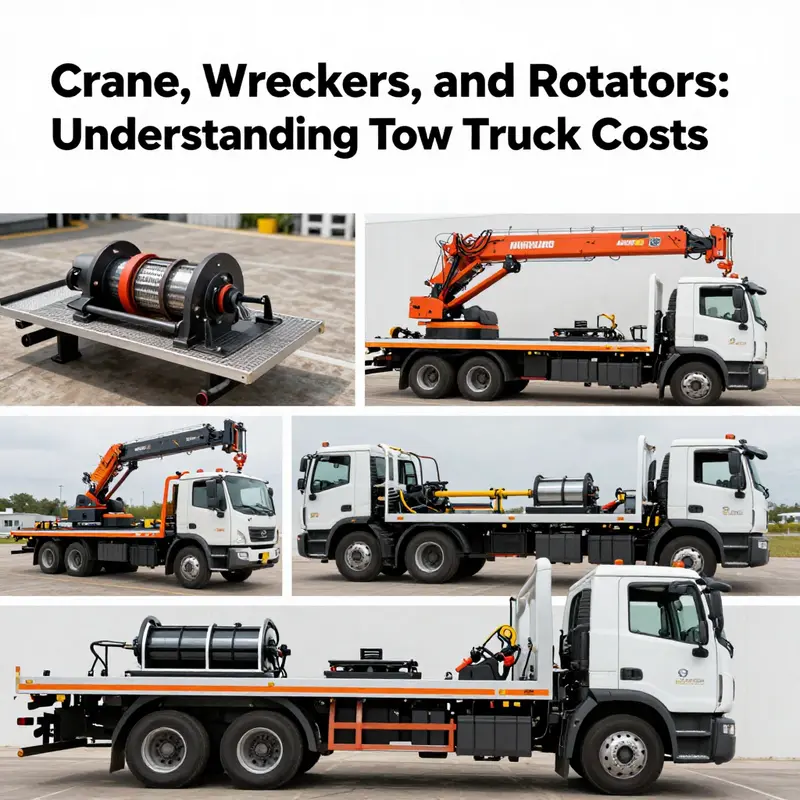

First, the most influential determinant is the type of towing mechanism at the heart of the truck. Rotator tow trucks, with their 360-degree rotating booms and heavy hydraulic systems, sit at the top of the price ladder. They are engineered for the toughest recoveries, from overturned vehicles to difficult terrain, and their ability to lift and rotate a vehicle into a stable position without manual rigging adds a level of capability that simply isn’t matched by other designs. That sophistication comes with a price tag commonly starting around one hundred fifty thousand dollars and climbing well beyond three hundred thousand in some configurations. The reason for such scale is not merely the extended boom and higher lifting capacity; it is also the need for robust hydraulic components, precise control systems, and the specialized training required to operate safely in complex rescue scenarios. In contrast, wheel-lift and flatbed configurations, while capable, lean on simpler mechanisms. Wheel-lift models use a yoke or fork to lift one end of a vehicle, which reduces upfront cost and maintenance but can introduce higher risk to undercarriages, especially for all-wheel-drive or low-clearance vehicles. Flatbed tow trucks, which place the entire vehicle on a tilting bed, embody the safest towing method and the most controlled vehicle loading. They tend to be more expensive than basic wheel-lift options due to the complexity of the hydraulic bed system and the precision needed to align and secure a vehicle. Prices for basic flatbeds can begin in the low tens of thousands for smaller, light-duty units, but mid-range and advanced flatbeds with longer beds, higher winches, and enhanced safety features move into the forty to seventy-five thousand-dollar range, and higher still when you add heavy-duty equipment, rapid-response configurations, or specialized tires and suspension.

Second, the degree to which the towing system is integrated into the chassis versus added as a modular, aftermarket-like setup is a major price lever. Integrated tow trucks feature a chassis that is designed from the outset to carry the towing apparatus as an inseparable part of the vehicle’s architecture. This integration translates into a tighter, more reliable platform with predictable load paths, easier maintenance, and improved safety margins during critical operations. The downside is a higher initial cost because the engineering, manufacturing, and certification work are more extensive. In practice, integrated designs often fall into the range of roughly seventy-five thousand to one hundred fifty thousand dollars for capable, production-grade platforms, with higher-end iterations for heavy-duty or specialized services pushing the envelope further. By contrast, modular or semi-integrated solutions—which allow a fleet to retrofit a truck with a tow unit after purchase—offer lower upfront prices but can incur incremental costs over time. They may require more frequent inspections, adjustments to payload ratings, and sometimes bespoke fittings to ensure a reliable and safe operation. The choice between integrated and modular simply reflects a balance between upfront capital efficiency and long-term maintenance predictability. For operators with variable workloads or tight capitalization cycles, a modular approach might make more sense; for those prioritizing reliability and resale value, an integrated solution often proves worth the premium.

Third, technological enhancements and the level of automation fed into the truck materially shape ongoing costs and performance. Today’s tow trucks increasingly incorporate features once reserved for high-end industrial equipment: remote operation capabilities, integrated fleet management software, high-visibility lighting packages, GPS-based dispatch, and advanced telemetry for preventive maintenance. Each layer adds value in ways that compound over the life of the vehicle. Remote control systems, for example, improve operator safety and precision when guiding a vehicle onto a bed or when performing delicate winching operations in tight spaces. They also introduce a cost premium because of the need for robust wireless hardware, secure communication links, and software updates that keep the system compatible with newer equipment. Fleet management software, meanwhile, connects the tow truck to dispatch, maintenance schedules, and regulatory compliance records. The initial software investment plus ongoing subscription fees represent a recurring cost, but the payoff is higher utilization rates, faster response times, and better compliance reporting. It is not just about adding features for the sake of modernization; it is about aligning capabilities with the sizes of the jobs you anticipate, the geographic areas you serve, and the regulatory environment you operate within. If your business model hinges on rapid urban responses or complex accident scenes, these upgrades can be essential; if you run a lean operation focused on occasional roadside assistance, some of these features may be optional luxuries rather than necessities.

Fourth, the intended application environment—urban vs long-haul, municipal roads vs rural corridors, routine roadside assistance vs heavy-duty recovery—drives both capability requirements and durability expectations, which in turn influence cost. Trucks serving urban or suburban areas benefit from compact designs, quick deployment times, and precise control systems tailored for predictable, frequent use. Heavy-duty operations, long-town deployments, or responses to complex incidents require higher lifting capacities, more rugged components, extended booms, and often more aggressive braking and stability systems. As a result, heavy-duty rotators or integrated high-capacity units not only cost more upfront but also require more expensive maintenance, specialized training, and higher fuel consumption, factors that compound year after year. Yet the same logic that pushes price up can also create value: a well-chosen, purpose-built platform minimizes downtime, reduces risk of damage to towed vehicles, and improves average revenue per incident through faster, safer recoveries. In other words, the relationship between environment, performance needs, and cost is tightly intertwined. A fleet that negotiates harsh terrains and unpredictable weather will likely justify the premium for a rotator or a high-capacity integrated unit, whereas a shop serving a high-volume urban corridor with predictable incidents may achieve a better return on investment from a mid-range flatbed with modern safety and remote features.

As these facets come together, the decision about what to buy becomes a calculation of long-term cost versus upfront price. It is tempting to chase the top-of-the-line option, but the most prudent choice depends on how often you expect to use the truck, the typical vehicle profiles you will encounter, and the level of risk you are willing to manage. Even within the same category, there is variability. A mid-range flatbed or wheel-lift may span a broad price band because of lift capacity, bed length, winching power, and crane integration. A small basic flatbed may be affordable at entry, yet a few upgrades—such as an enhanced winch, higher load rating, better tires, and an upgraded lighting package—can lift the price by a noticeable margin. When evaluating proposals, it pays to demand a transparent line-item breakdown: the base chassis, the towing system, the control and safety features, and the maintenance plan. The cost of safety gear, cones, reflective vests, and the necessary per-incident supplies should not be an afterthought. The same principle applies to training and certification; an operator who understands the nuances of different vehicle profiles andRecovery procedures is less likely to cause costly damage or face prolonged downtime on the job.

In practice, buyers often compare a spectrum of options rather than fixating on a single model. The cheapest new platform might seem attractive in the short term, but it is not always the most economical choice over five to ten years when maintenance, uptime, and replacement cycles are counted. Conversely, a premium rotator or highly integrated system must be weighed against the volume and mix of work—it may be overkill for a shop that seldom handles recoveries beyond light-duty trucks. The industry literature that guides these decisions emphasizes a few recurring cautions: request a detailed cost breakdown before purchase, consider the long-term maintenance and fuel implications, and acknowledge regional variations in freight, import costs, and regulatory compliance that can shift total cost of ownership. And because pricing is dynamic—driven by brand, configuration, and market shifts—buyers should keep a conservative view on resale value and potential obsolescence when assessing the price tag.

For readers who want a quick primer that maps the landscape before engaging vendors, a concise overview is available under the how-much-is-a-tow-truck resource. It provides a snapshot of typical price bands across the major configurations and highlights the tradeoffs discussed above. See how-much-is-a-tow-truck. For those seeking broader benchmarks or regional pricing guidance, industry aggregators and guides offer a broader field of comparison, including the mid-range and high-end configurations that are common in commercial fleets. In every case, the path to smart pricing remains the same: anchor the decision in the expected workload, align features with operational risk and dispatch needs, and insist on a transparent, itemized quote that separates the core platform from the add-ons and future-proofing features.

By anchoring decisions in the real work you expect to perform, you can translate list prices into meaningful value. The cheapest option may not survive a season of harsh weather or high- casualty rates; a mid-range platform with a robust integrated system may yield higher uptime, faster incident resolution, and a lower overall cost of ownership even if the upfront price is higher. The most expensive rotator is not always the best choice for every operator; a thoughtful balance of capability, reliability, and cost can deliver superior, predictable returns. As you posture for procurement, remember that the market price is not a fixed number but a negotiation surface shaped by your needs, the configuration chosen, and the level of ongoing service and training you require. In that light, the chapter on features that affect tow truck cost becomes not a shopping list but a decision framework—one that helps you weigh durability, safety, efficiency, and long-term value as you walk into the showroom or the supplier meeting room with clarity and confidence. External benchmarks and further reading can help anchor those conversations, but the core is a practical understanding of how each design choice translates into dollars and into safer, faster, and more reliable recoveries on the road. External reference: https://www.towtruckguide.com/new-tow-truck-prices-overview

Final thoughts

Understanding the costs associated with tow trucks is vital for anyone involved in vehicle recovery or roadside assistance. From new models designed for heavy-duty tasks to used trucks offering budget-friendly options, each choice comes with its unique set of financial implications. By considering initial purchase prices as well as ongoing costs related to maintenance and equipment, buyers can make informed decisions that align with their operational needs. As the demand for reliable towing services grows, investing in the right tow truck can significantly impact efficiency and customer service.