Tow trucks power roadside relief, fleet operations, and on-site recovery – making cost awareness essential for everyday drivers, residents, truck owners, auto repair shops, dealerships, and property managers. Prices vary widely by size, capacity, and type: a compact medium-duty tow truck can start around $15,990, while standard 5-ton wreckers and mid-range units sit in the $18,000-$29,000 zone, and heavy-duty 50-ton 8×4 wreckers can span $40,000-$70,000 per unit. For specialized uses like semi-trailer towing, prime movers can begin near $18,000, depending on configuration. Yet sticker price is only the starting line. Total cost of ownership includes insurance, maintenance, tires, parts, downtime, fuel, financing terms, and after-sales support. Regional factors such as shipping, duties, and tax regimes further shape final numbers. Customization options, warranty terms, and the availability of service networks can tilt the value proposition as much as the base price. With buyers ranging from individual operators to fleets and property managers, the decision framework must balance upfront affordability with uptime reliability and long-term cost.

Pricing the Tow Line: Market Segmentation and Real-World Price Ranges Across Light, Medium, Heavy-Duty, and Prime Movers

Towing equipment is more than a tool for moving a stranded vehicle. It sits at the crossroads of safety, reliability, and operational efficiency. When fleets, municipalities, and independent contractors plan acquisitions, they start with cost but soon consider value: how a machine performs, what it can recover, and how long it will operate with predictable maintenance. Price is a spectrum shaped by capacity, design, and the features that enable a tow operation to run smoothly through busy shifts and challenging environments. The market range is broad enough to accommodate small operators and large fleets, yet nuanced enough that mispricing can lead to higher long term costs. Understanding segmentation by capacity and the associated price bands helps buyers align purchase decisions with actual needs, avoid overbuying, and plan for total cost of ownership.

Light-duty category covers up to roughly 15,000 pounds and typically sits in a price band around 30,000 to 60,000 USD. This level includes standard recovery setups with a winch, basic hydraulics, and a compact chassis suitable for urban work. Within this band, higher-grade components or stronger winches push toward the upper end, while simpler configurations can land closer to the lower end.

Medium-duty work covers about 15,001 to 25,000 pounds, with a price corridor roughly 60,000 to 120,000 USD. The extra capacity brings a more capable chassis, heavier winches, longer reach, and better handling for a broader mix of vehicles. Fleets with regular need for medium-duty vans, pickups, and small trucks may invest toward the upper end for durability and recovery speed.

Heavy-duty units are designed for large trucks, buses, and construction equipment, typically ranging from 120,000 to 250,000 USD or more. Higher cost is driven by a reinforced chassis, advanced hydraulics, multiple winches, and options such as flatbeds or cradle designs, plus enhanced safety features.

Prime movers (tractor units) sit in a price band around 100,000 to 200,000 USD and beyond, depending on trailer integration and towing controls. These are optimized for long-haul recovery and high-volume operations.

Beyond capacity, other cost drivers include configuration choices (flatbed versus cradle or integrated systems), safety electronics, cameras, maintenance, warranties, and service packages. Regional price variations and total cost of ownership considerations also shape decisions, as do procurement terms and the resale market. A thorough needs assessment and a well-documented maintenance history help ensure that the chosen unit delivers reliability and value over its life.

In the macro view, buyers should consider market signals and forecast trends that influence pricing, such as the shift toward more specialized, multi-functional units and improvements in efficiency and safety. A disciplined approach—balancing upfront price with maintenance costs, uptime, and training needs—yields the best long-term value.

Sizing Up the Bill: How Size, Capacity, Type, and Customization Shape Tow Truck Prices

When fleets and independent operators start shopping for a tow truck, the sticker price is only the tip of the iceberg. The actual outlay depends on a careful blend of size, towing capacity, service type, and the upfits that tailor a machine to a specific job. Price is never a single number; it is the product of a series of decisions about what the truck must do, where it will operate, and how long the equipment must perform reliably in demanding conditions. To understand the landscape, it helps to map the common categories and their typical price bands, while keeping in mind that the figures cited reflect the vehicle itself and usually exclude the costs of shipping, duties, insurance, introductory warranties, or lengthy after-sales service plans. Even within a single category, the final price can drift by thousands or tens of thousands of dollars depending on the engine, transmission, hydraulic system, winches, safety features, and the level of customization chosen. For anyone contemplating a purchase, these distinctions matter because they determine not just the upfront cost but the longer-term value and total cost of ownership.

Size and capacity are the most visible price drivers. Larger, higher-capacity tow trucks are more expensive because they demand stronger frames, heavier axles, more powerful engines, and more robust hydraulic systems. Heavy-duty wreckers with 50-ton capacity, often built on 8×4 chassis configurations, sit at the upper end of the price spectrum for a reason. A representative 50-ton heavy-duty wrecker from a major manufacturer can command a price range from roughly forty thousand dollars to seventy thousand dollars per unit in 2026 market conditions. That price bracket reflects not just the raw lifting capability but the durability needed for frequent, long-duty cycles in all weather and road conditions, the ability to handle overturned vehicles, and the reliability demanded by emergency responders and large fleets. In practice, these trucks are the workhorses behind on-highway recovery operations and are rarely the choice for casual, light-duty towing; they are the long-term investment a fleet makes when it must recover heavy trucks, buses, or structurally compromised vehicles.

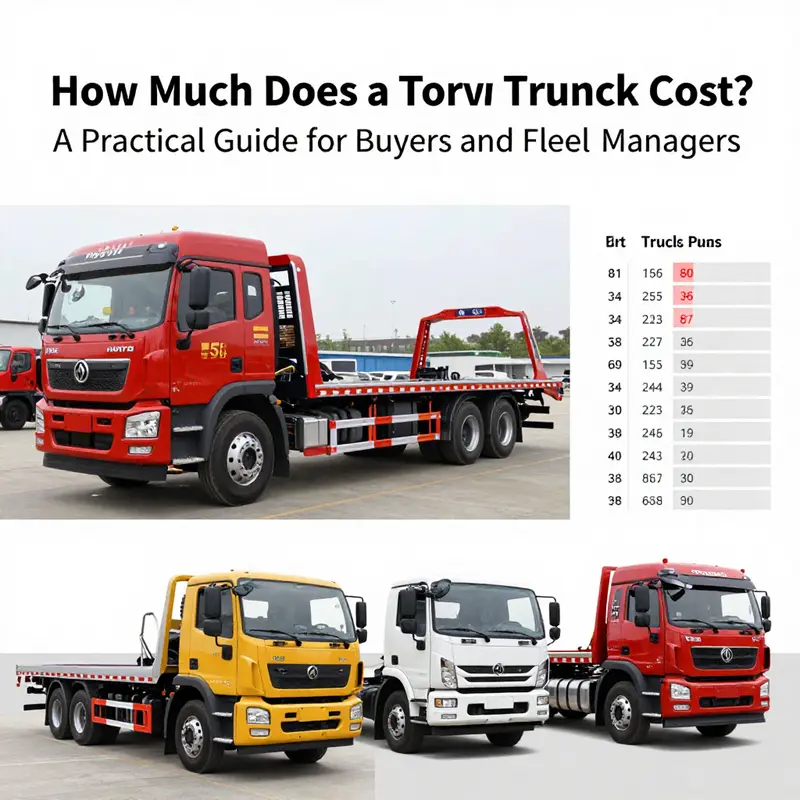

Smaller, more nimble machines—flatbeds and standard wreckers—occupy the other end of the price spectrum. A mid-range option for many daily operations is a four-ton flatbed wrecker, which often carries a factory price somewhere around the upper teens to mid-twenties thousand dollars. In one widely cited configuration, a four-ton flatbed wrecker could appear at a factory price of about sixteen thousand dollars, with variations depending on engine power, bed length, and auxiliary equipment. This class is attractive for standard vehicle towing because the flatbed provides secure loading for modern cars, SUVs, and light-duty trucks, and reduces the risk of secondary damage during transport. The flatbed’s hydraulics and tilting bed also simplify loading in tight spaces or on uneven terrain, a practical advantage for urban environments where maneuverability and driver safety matter as much as raw lift capability.

Standard wreckers in the five-ton range sit in a comfortable middle ground. A well-known option in this category is a four-by-two platform towing truck that can handle about five tons. The price for a new unit in volumes can start in the high twenty-thousands and, depending on the supplier and configuration, move toward the low thirty-thousands for basic outfits. A closely related alternative is a five-ton wrecker in a similar, or slightly wider, price band. For example, one widely cited market option lists around twenty-nine thousand dollars for a small quantity range to eight-ninety-nine thousand dollars for larger orders when certain promotions apply; other suppliers offer five-ton units from roughly eighteen thousand dollars to just under forty thousand dollars. These ranges reflect not only the weight they can lift but the design choices that affect handling, fuel economy, maintenance intervals, and the level of specialized equipment installed at the factory. In some markets, even five-ton machines can dip below twenty thousand dollars if the purchase is bundled with other equipment, or if the unit is a basic, no-frills model designed to be upgraded with aftermarket gear after delivery.

A separate but related category is the prime mover or tractor unit used for semi-trailer towing. While a traditional tow truck is built to recover vehicles, a prime mover is designed to haul large trailers and mustered to endure long hauls in addition to on-road recovery. In practice, a simple 6×4 prime mover can appear at surprisingly low sticker prices in some markets, with examples around eighteen thousand dollars for basic configurations. It is important to note that while this price makes sense for a prime mover intended for trailer hauling, it is a different animal from a dedicated tow truck intended for vehicle recovery. The drivetrain, coupling systems, and braking requirements for highway trailer transport introduce a different maintenance profile and a different set of regulatory requirements. Prices in this category can be sensitive to the degree of customization, the presence of a sleeper cab, and whether it is intended strictly for towing or to handle a broader range of logistical tasks.

The picture sharpens when we turn to specialty types, where price does not always track linearly with capacity. The rotator tow truck, which features a 360-degree rotating boom capable of lifting a vehicle from any angle and position, stands as the most expensive end of the spectrum. Rotators are engineered for heavy-duty recovery, overturned trucks, and rapid, complicated emergency responses. The market price for a rotator typically begins around one hundred fifty thousand dollars and can climb well beyond three hundred thousand dollars, depending on the configuration, the range of lifting arcs, hydraulic power, stabilization apparatus, and the sophistication of the control systems. This price premium reflects far more than raw lift power: rotators demand high-grade materials, highly specialized hydraulics, precise control mechanisms, and safety systems capable of supporting life-critical operations under extreme stress. In many regions, agencies may evaluate rotators not simply on lift capacity but on how quickly they can stabilize a vehicle, how well they can coordinate with other emergency assets, and how reliably they can perform complex maneuvers without endangering the driver or bystanders.

Flatbeds, by comparison, tend to be more affordable and versatile, particularly for modern passenger cars and light-duty trucks. A hydraulically tilting bed that lifts the vehicle onto a frictionless platform minimizes ground contact and transfer damage. In the current market, flatbeds occupy a broader range of prices than rotators, as they include simple two-wheel-drive configurations through to four-wheel-drive or all-wheel-drive setups with upfits such as wheel-lift attachments and integrated winches. The security of the load, the capacity of the bed, the range of bed lengths, and the sophistication of the hydraulic system all influence the price. A well-equipped flatbed can be pricier than a basic wrecker, but often remains substantially less expensive than a rotator, especially when buying a standard model designed primarily for routine recoveries rather than complex phantom operations in the field.

Another factor that shapes price is the towing capacity and the overall size of the vehicle being designed to handle the job. The HOWO Car Carrier Flatbed Wrecker Truck, for example, demonstrates how configurations and capacity interact. It offers a towing capacity of about four tons, or roughly eight thousand eight hundred pounds, and comes in multiple dimensions such as 5000×2300 millimeters, 5750×2300 millimeters, and 6995x2600x3000 millimeters. Engines in these configurations range from about 120 horsepower to 160 horsepower, with corresponding shifts in performance for climbing, braking, and fuel economy. Each variant adheres to a different balance of payload, reach, and maneuverability, and that balance will steer the price. In similar fashion, fifth-wheel towing trucks—built to tow heavy trailers rather than vehicles—often feature capacities between nineteen thousand and thirty-eight thousand pounds. The size of these trucks is typically larger and less maneuverable in tight spaces, and the engineering demands drive up the cost, reflecting the higher materials, gear trains, and braking systems required to manage such loads.

The customization factor cannot be overstated. Operators seldom buy a factory-standard machine and leave it as-is when their work environment imposes unique demands. Customization can range from mild, practical enhancements to advanced, mission-critical systems. A few illustrative examples include upgraded winches with higher pull ratings, more capable suspension systems that handle rough terrain or uneven roadside shoulders, specialized safety equipment such as enhanced lighting and reflective markings, and custom paint or branding that improves visibility and fleet identity. Each of these modifications adds to the final price, but they can also translate to faster recovery times, safer operations, and lower maintenance costs in the long run. The same applies to auxiliary features like advanced traction control for slippery surfaces, heavy-duty cables and hooks, additional tool storage, and digital control interfaces that simplify operator workload and reduce the risk of human error on critical calls.

Regional considerations also shape final costs. Price quotes that come from the factory or a domestic distributor may differ substantially from those that incorporate shipping, insurance, import duties, and after-sales support in a given country. A range of regional factors—from tax structures to currency exchange rates and local labor costs—will influence the bottom line. For this reason, buyers are advised to approach procurement with a two-stage plan: first, establish the required specifications and the rough target price based on the operational needs; second, obtain formal quotations from multiple suppliers, clearly outlining the scope of delivery, warranty terms, service networks, and the potential for post-purchase support contracts. The literature on current market data for commercial towing trucks emphasizes direct engagement with manufacturers and authorized dealers to ensure that quoted prices reflect the precise configuration and regional conditions. A practical route to market insight is to consult real-time listings and pricing trends from trade platforms such as TruckPaper, which aggregates vendor feeds and reflects current market dynamics across North America.

Beyond the price tag, evaluating value requires a forward-looking lens. Operators need to consider maintenance costs, fuel efficiency, and the expected lifespan of critical components given the truck’s duty cycle. A rotator may come with a premium maintenance regime and higher parts costs, but it can also deliver unparalleled capability in extreme recovery scenarios. A flatbed, while simpler, may require more frequent bed or hydraulic system inspections, depending on the load and frequency of use. In either case, the total cost of ownership will hinge on how intensively the truck is used, the reliability of the supplier’s service network, and the availability of spare parts in the operator’s region. A strategic approach to budgeting, therefore, balances upfront price with anticipated uptime, dealer support, and the potential for resale value when fleet refresh schedules arrive.

For those who want a snapshot of current market data before negotiating, a quick reference point is to explore published price bands across the major categories. A rotator’s price, as noted, sits well into the six-figure range, with many configurations moving into or beyond the upper end of the seven-figure range when bespoke equipment or extreme-duty specifications are requested. Flatbeds generally occupy a lower tier, with basic four-ton units starting in the mid-to-high teens and more fully equipped variants in the thirty-thousand-dollar region or higher, depending on brand, drivetrain options, and added safety features. Mid-range five-ton wreckers fall somewhere in the neighborhood of twenty to thirty thousand dollars, though promotions, volume purchasing, or bundled equipment can shift these prices downward in bulk scenarios. Heavy-duty 8×4 50-ton wreckers, while capable of extraordinary lifting, are often priced around forty to seventy thousand dollars, illustrating how capacity and durability translate into cost without the rotator premium. The prime mover category, when used in trailer towing contexts, often reflects a wide spectrum—from the low end in the teens to higher figures that incorporate sleeper cabs, advanced braking systems, and compliance features. The key point across all categories is that capacity and application drive value. A fleet’s decision calculus should begin with a precise definition of the heaviest loads the truck must recover, the typical recovery environment, and the mandated standards for safety and reliability.

For readers who want to explore pricing in a broader market context, there is value in consulting current market data on reputable industry platforms. If you’re seeking more information and a live view of listings, you may find that the following external resource provides up-to-date market data and pricing trends across North America: TruckPaper. This external reference offers real-time listings and commentary that can help buyers calibrate their expectations against the latest market movements and the mix of new and used units available. Understanding these trends can help a buyer decide whether to pursue a brand-new unit with full warranty, a lightly used model with potential cost savings, or a customized build that aligns with long-term maintenance and operating goals. In all cases, price should be interpreted within the broader frame of reliability, uptime, and service capability—the three pillars that determine the true cost of ownership for any towing operation.

The practical takeaway is clear. Price is a function of how the truck is meant to be used. A rotator’s extraordinary versatility comes at a premium, while a flatbed offers a safer, simpler solution with lower upfront cost and maintenance demands for most modern cars. Capacity and size are not merely about raw lifting figures; they dictate the engineering complexity, control systems, and durability necessary to perform under stress. Customization, though it adds immediate cost, often buys long-term value by enabling faster, safer recoveries and reducing downtime. And while regional factors will modify the final number, the fundamental logic remains stable: match the truck’s capabilities to the operational demands, then layer on the safety, reliability, and service support that keep a fleet moving through peak demand and unpredictable conditions.

To keep this framework practical, consider one concrete approach to pricing: begin with a crisp specification sheet that answers three questions—what is the heaviest load the vehicle will need to tow or lift, what environments will it operate in (urban streets, highways, rural roads, or on-ramps and shoulders), and what level of automation or safety features will the crew rely on? With those answers in hand, request formal quotations from several manufacturers or authorized dealers, and ask for a breakdown that separates the base chassis price from the cost of specialized equipment, hydraulics, and any required upfits. When comparing proposals, look for consistency in the scope of delivery, warranty terms, and after-sales support. This helps ensure you’re comparing apples to apples and reduces the risk of unpleasant surprises when the unit arrives or when it is needed most on a critical call.

For readers seeking a deeper dive into price specifics and model-by-model comparisons, here is a widely recognized starting point for consumer and professional buyers alike: How much is a tow truck? how-much-is-a-tow-truck. This internal resource can provide a quick frame of reference for the kinds of price ranges discussed above, along with practical guidance on evaluating quotes and negotiating with suppliers. While it is not a substitute for a formal quote, it offers a useful baseline to anchor the early stages of procurement. As with any major equipment purchase, the goal is to align the investment with the mission—ensuring that the truck you select can perform its duties safely, efficiently, and with a clear path to dependable service and spare-part support over the long haul.

In closing this exploration of price drivers, it’s helpful to remember that the numbers we’ve reviewed are not isolated figures but points on a spectrum shaped by the type of recovery work, the need for resilience under demanding conditions, and the operational tempo of the fleet. A four-ton flatbed is not simply smaller than a 50-ton wrecker; it represents a practical compromise between capability, cost, and daily usability. A rotator is not merely more expensive; it is a tool designed to solve the most challenging, time-sensitive recoveries when there is little margin for error. And a customized solution, while more costly at purchase, can yield a lower total cost of ownership if it reduces downtime and extends component life. With this lens, buyers can navigate the market more confidently, ask better questions, and select a vehicle that not only fits the budget but also delivers measurable value in recovery performance, safety, and reliability over the vehicle’s service life. The ensuing chapters will build on this foundation, translating these principles into practical guidelines for assessing needs, evaluating vendors, and choosing financing options that align with project scopes and cash-flow considerations.

External resource for further market data: TruckPaper. https://www.truckpaper.com/

Counting the Cost of a Tow Truck: From Purchase Price to Fleet-Wide Profit

When a fleet operator starts shopping for a tow truck, the sticker price is only the first line in a longer balance sheet. The market currently offers a broad spectrum of configurations, from compact light-duty units designed for quick roadside assistance to heavy-duty wreckers capable of recovering large, immobilized vehicles. Across the board, the price tends to scale with capacity, build quality, and the degree of specialized equipment. In practical terms, buyers should be prepared for a purchase price that reflects not only the vehicle’s size and payload but also the intended use, the expected duty cycle, and the geographic realities of service coverage. Rather than treating the cost as a single number, seasoned buyers view it as the starting point of a longer financial conversation about how the asset will contribute to revenue, how reliably it will perform, and how quickly it will pay for itself through improved uptime and efficiency. For those new to the process, it helps to categorize options by the core use case: heavy-duty recovery for large vehicles and complex scenes, mid-range fleets handling a mix of standard cars and light trucks, and compact units aimed at fast, urban response where speed and maneuverability matter more than extreme lifting capacity. Each category carries its own price band, and those bands are influenced by configuration details, regional supply chains, and ongoing support options. The broad takeaway is that the initial outlay is just a doorway to the ongoing, multi-year value the vehicle can unlock when managed as part of a coherent fleet strategy. A useful reference point for price discourse is that the cost landscape is shaped by region, configuration, and the level of customization a buyer is willing to accept. For context, market data from early 2026 highlights a spectrum that begins well below twenty thousand dollars for basic, smaller platforms and climbs toward the high tens of thousands for heavier, more specialized platforms. It is important to note that these figures exclude shipping, import duties, insurance, or after-sales service. The final number will always be bid up or down by where the supplier is located, what warranty terms are offered, and how much on-site training and support are included. In other words, the purchase price acts as a first frame in a larger portrait of ownership costs, not a verdict on total value. When shop-floor conversations begin, many buyers discover that price bands also reflect differences in build quality and reliability, the presence of advanced recovery systems, and the level of integration with fleet-management ecosystems. A high-quality chassis and a robust carrier framework may add to the upfront cost, but they can translate into lower maintenance burdens and longer life, especially under demanding recovery workloads that include frequent idling, rough terrain, and heavy payloads. The towing industry often emphasizes the need for durability, but durability must be balanced with efficiency, safety, and operability in the field. This balance shapes how buyers weigh up procurement choices in the context of total cost of ownership (TCO), not merely the purchase price. The TCO approach asks how much money the fleet will spend across the life of the asset, from financing and taxes to fuel, tires, maintenance, insurance, parts, and parts availability, plus depreciation and disposal. In practice, TCO concerns begin with the fuel system and the engine’s operating economy. Tow trucks, especially when loaded during a recovery operation, can burn through fuel at rates that seem steep in comparison with everyday road vehicles. Industry experience suggests that an engaged operator could see fuel economy in the range of roughly 6 to 10 miles per gallon when the vehicle is carrying a load, a constraint that underscores the value of route optimization and disciplined scheduling. In addition, frequent idling—an integral part of many recoveries—can dramatically inflate fuel consumption and wear. This is where fleet managers turn to telematics, route-planning software, and maintenance scheduling as tools to stretch every mile. When a truck sits idling at a scene or on a staging point, not only does fuel usage rise, but engine wear and cooling system strain can increase as well. The practical implication is that investing in software-enabled route optimization and idle-reduction practices is often as important as buying the right truck itself. The broader message is simple: optimizing utilization is a lever that can reduce the TCO even when upfront costs rise due to higher build quality or more capable equipment. The cost structure also hinges on the included or optional equipment that accompanies the tow truck. Light bars, sirens, communication systems, winches, hydraulic lift mechanisms, and attachment tools all contribute to the upfront price and ongoing maintenance. Each piece of equipment has its own maintenance profile, spare parts footprint, and potential downtime implications if it fails in the field. Fleet operators who anticipate long service life and high utilization typically base their purchasing decisions on a modular approach. They prefer platforms that can be upgraded with new recovery technology, sensors, or communication gear as needs evolve, rather than starting from scratch with a new vehicle for every upgrade cycle. This philosophy also translates into better resale value and smoother transitions between fleet generations, especially in markets where regulatory requirements for safety equipment and lighting are stringent. The procurement process itself is less about chasing the lowest price and more about achieving predictable total costs and reliable aftermath support. Buyers should begin with a clear specification: the intended load capacity, the typical duty cycle, the expected operating environment, and the required safety and communications suite. Next comes a rigorous comparison of total cost of ownership across multiple configurations. This involves collecting quotes that itemize not only the base price but also mandatory add-ons, extended warranties, maintenance agreements, and any training packages included in the deal. An important strategic criterion is the durability and availability of spare parts within the operator’s geographic reach. A vehicle might be cheaper upfront in a distant market, but high shipping costs, extended downtime due to parts shortages, or long service intervals can erase the price advantage. The interplay between supplier location and service network matters, especially for fleets that operate across metropolitan areas and rural corridors where downtime is highly disruptive. In recent years, purchasers have increasingly valued warranties and service commitments that offer on-site maintenance windows, rapid-response technician visits, and guaranteed parts supply timelines. These features can dramatically lower downtime and keep the fleet operating near its maximum capacity. Buyers should also consider the potential tax implications and any incentives that apply to commercial vehicle purchases, which can influence the effective cost over the first few years of ownership. Financing and leasing options deserve careful scrutiny as well. A growing portion of fleets prefers structured leases that bundle maintenance and coverage into a single monthly payment, converting large, irregular capital expenditures into predictable operating expenses. This approach aligns with fleet budgeting and helps avoid sudden capital outlays that could constrain other critical investments. It is important to align the financing term with the expected useful life of the asset and the fleet’s replacement cycle. A well-structured agreement can also incorporate upgrade paths so that a vehicle entering the fleet can be refreshed with newer technology as the operational environment evolves, while preserving some continuity in maintenance practices and driver training. When buyers weigh the balance of upfront price against long-term savings, the perception of risk plays a central role. An asset with a lower purchase price might require more frequent repairs, higher maintenance costs, or more expensive spare parts. Conversely, a higher-priced platform with high build quality and a robust service network can reduce risk by delivering greater uptime and more predictable maintenance budgets. Operational risk is not only a function of mechanical reliability but also safety and compliance. Tow operators must consider how equipment such as safety lighting, load restraint systems, and secure mounting for heavy recoveries influences incident handling. Modern recovery scenarios increasingly require integrated communication platforms and digital logging to ensure proper documentation, incident reporting, and adherence to regulatory standards. The friction between up-front cost and operational resilience is a central tension in any large fleet decision. Procurement teams should run scenarios that quantify how different configurations perform under typical workloads and how those outcomes translate into revenue, uptime, and customer satisfaction. A disciplined TCO analysis tends to reveal that the cheapest vehicle in the showroom may fail to deliver the required uptime or parts availability, ultimately diminishing margins. For those who want to ground their decisions in data, there are market analyses and practical benchmarks that synthesize performance metrics and ownership costs. These resources help compare how different recovery platforms perform across categories and usage profiles, factoring in real-world feedback from operators, warranty performance, and the total cost of ownership over a multi-year horizon. In addition to raw price and reliability data, buyers should weigh the intangible benefits of a strong vendor relationship — a reliable supplier can become a partner in fleet optimization, offering training, upgrades, and targeted solutions as the business evolves. The decision framework should also account for the fleet’s mission profile. Urban recovery fleets, which often require nimble handling and fast deployment, may justify investment in lighter, more maneuverable platforms with efficient electronic systems. Rural or heavy-duty contracts, by contrast, typically demand larger payloads and more robust recovery gear, where the payoff comes from higher uptime and the ability to manage increasingly complex scenes. The 2025–2026 market landscape reflects this diversity, with manufacturers and suppliers offering a wide array of configurations and service options. For buyers seeking a data-driven frame of reference, industry discussions emphasize comparing models based on three pillars: towing capacity and build quality, the innovativeness of the recovery system, and the overall ownership experience, including service networks and support. Each pillar contains several layers of detail, from the reliability of the winch and hydraulic systems to the responsiveness of the customer support team and the speed at which parts can be delivered. Buyers who approach the process holistically will likely discover that the most cost-effective choice is not the lowest headline price but the configuration that delivers the highest uptime, the lowest risk of unexpected bills, and a support ecosystem that minimizes downtime during critical incidents. A practical path to achieving this balance is to ground the procurement in a careful comparison of total costs, forecasted utilization, and risk tolerance. To illustrate the breadth of factors that influence cost, consider the following non-exhaustive list of influencing elements. The upfront price is shaped by the chassis specification, drivetrain choices, and the scope of recovery equipment installed. Ongoing costs include inspection regimes, routine maintenance, tire wear, hydraulic fluid changes, and potential component replacements after heavy use. Insurance costs depend on payload, usage profile, and regional insurance markets, while licensing and registration follow jurisdictional rules that may add administrative expenses. Depreciation is an inevitable tax and accounting factor that affects the after-tax economics of ownership, and resale value may hinge on build quality, maintenance history, and the vehicle’s uptime record. The decision-making process is therefore as much about managing risk and ensuring predictable costs as it is about securing the lowest price. The most effective procurement practices also involve a continuous feedback loop. Operators who systematically track uptime, maintenance costs, fuel efficiency, and service response times can refine future purchases, closing gaps between expectations and actual performance. This cycle of evaluation becomes a cornerstone of fleet optimization, enabling organizations to align asset choices with evolving service levels and client demands. In sum, the economics of owning a tow truck hinge on more than a single price tag. It requires a disciplined approach to purchase, a strategic plan for maintenance and parts availability, and a proactive stance on optimization and safety. The potential return on investment emerges not just from the vehicle’s lifting capacity or the speed of its deployment, but from how well the asset integrates with the rest of the fleet—how reliably it operates in the field, how efficiently it uses fuel, and how effectively it is supported through the life of the contract. For readers who want a concise, data-driven snapshot of current market dynamics and model comparisons, a well-regarded English-language resource provides a structured evaluation of ownership costs alongside performance metrics. The discussion therein highlights how owners weigh payload, build quality, innovation, and total cost of ownership when selecting a rollout strategy for urban versus rural recovery needs. When you are ready to drill down further into price specifics and the working economics of a tow truck, consider exploring the price and procurement guidance linked in this chapter’s references. For a broader context on the cost landscape and to compare market offerings beyond your region, an external resource presents a data-driven framework for assessing how different rollback tow trucks perform and what they cost to own over time. This perspective helps frame the purchase decision not as a one-time expenditure but as a strategic investment in fleet resilience, service reliability, and financial predictability. internal link: how-much-is-a-tow-truck to situate price ranges within the broader TCO framework. As you explore the nuances of financing versus outright purchase, you will see how choosing a vehicle with a higher upfront price can be justified by longer service life, lower downtime, and greater compatibility with a modern telematics ecosystem. In the end, the value of any tow truck to a fleet is not just the dollars spent in the first year but the dollars saved across successive years through uptime, efficiency, and reliability. This perspective invites a shift from price-first thinking to value-first decision-making, where the total ownership experience guides the final selection. For readers seeking a grounded, numbers-driven comparison, the field has matured to offer benchmarks and case studies that quantify how maintenance costs evolve, how fuel prices influence operating budgets, and how uptime correlates with customer satisfaction and revenue growth. It is this broader view that helps fleet managers justify investments in more capable platforms, even when the initial price tag is noticeable, because the long-term returns in performance, reliability, and service continuity are the true measures of cost efficiency. External resource reference: for a data-driven comparison across market leaders and ownership costs, see https://www.towtruck.com/top-10-best-rollback-tow-trucks-to-buy/ as a complementary benchmark to the framework presented here.

Final thoughts

Understanding the price landscape for towing trucks means looking beyond the sticker price. By mapping market segments, recognizing the primary price drivers, and planning for total cost of ownership, everyday drivers, fleets, auto shops, and property managers can make decisions that balance upfront affordability with uptime, reliability, and long-term value. Whether you need a compact 4-ton flatbed for light-duty work, a standard 5-ton wrecker for routine recoveries, or a heavy-duty 50-ton machine for demanding recoveries, the right choice aligns with your workload, budget, and service commitments. The practical takeaway is to quantify not just the initial purchase, but the full lifecycle costs—maintenance, insurance, downtime, and resale value—and to choose procurement paths (new vs. used, dealer vs. importer) that fit your operating reality. With a structured approach, you’ll select a tow truck that serves your needs today while keeping a clear eye on tomorrow’s costs and opportunities.