Tow truck drivers occupy a crucial niche in roadside assistance, towing operations, and vehicle recovery. Earnings for this role are not a single number; they reflect a patchwork of regional pay scales, company policies, and job types—from emergency response and urgent on-call work to routine transport and recovery. Recent data synthesized from major platforms in the United States show an average weekly income around $1,736 (roughly $21.14 per hour) with notable variation by geography, employer, and whether overtime is included. The UK market presents even more regional divergence, where pay can swing substantially by area and the source of salary information. In Canada, national hourly averages hover around the mid-teens, but large urban centres and specialized fleets push earnings higher through overtime, on-call pay, and shift differentials. This article connects these regional pictures to the broader question: how much does a tow truck driver earn, and what should drivers, owners, and managers expect when planning compensation, budgeting, or recruitment? Each chapter draws on real-world patterns, with practical takeaways for Everyday Drivers, Residents & Commuters, Truck Owners, Auto Repair Shops & Dealerships, and Property Managers. Expect a data-informed view that highlights not only base rates but the total compensation potential shaped by location, overtime, benefits, and the specific industry niche driving demand.

Tow Truck Wages on the American Road: Reading the Numbers Behind an Essential Trade

Wages for tow truck drivers form a complex picture that reflects geography, job scope, and the rhythm of a 24/7 service industry. When someone asks how much a tow truck driver earns, they are really asking about a moving target shaped by where you work, how you work, and what kind of duties you perform. The most current snapshot comes from salary databases that aggregate salaries posted by employers and workers across the nation. As of late 2025, estimates show an average hourly wage around 21.14 dollars, which translates to roughly 44,000 dollars per year for a standard full-time schedule. This single number sits within a wide spectrum: pay can dip toward the low end or surge in markets that prize speed, availability, and specialized skills. Data sets spanning hundreds of thousands of salaries capture real-world variation across regions, employer types, and job responsibilities. In practice, the headline number is not a fixed rate but a benchmark reflecting a broad national snapshot rather than a single company payroll.

The national average is not the only voice; some sources report lower averages, underscoring that different datasets, definitions, and time frames can produce divergent results. More recent data tend to offer a clearer picture of prevailing wages when considering on-call shifts, overtime, and the varied responsibilities of roadside service, emergency response, or standard towing. Readers should triangulate multiple sources rather than rely on a single figure. The headline wage serves as a baseline from which local geography and employer policies can shift the final figure.

Beyond hourly rate, the annual picture for full-time workers depends on hours worked and how those hours are valued by an employer. Using the average as a baseline, a 40-hour workweek over 52 weeks yields about 44,000 dollars a year before taxes and benefits. Many tow truck drivers work irregular hours, including nights, weekends, and on-call periods that can boost compensation through overtime pay or shift differentials. This leads to a broad distribution: some earn near the low end of weekly pay, while others earn significantly more in busy metros or specialized fleets. Data often show a weekly range, from around 840 dollars to around 3,588 dollars, depending on overtime, on-call status, and whether bonuses are included. The annual totals then reflect hours, local economy, and compensation structure. In other words, the same job title can map to a very different annual experience by region and by employer contract.

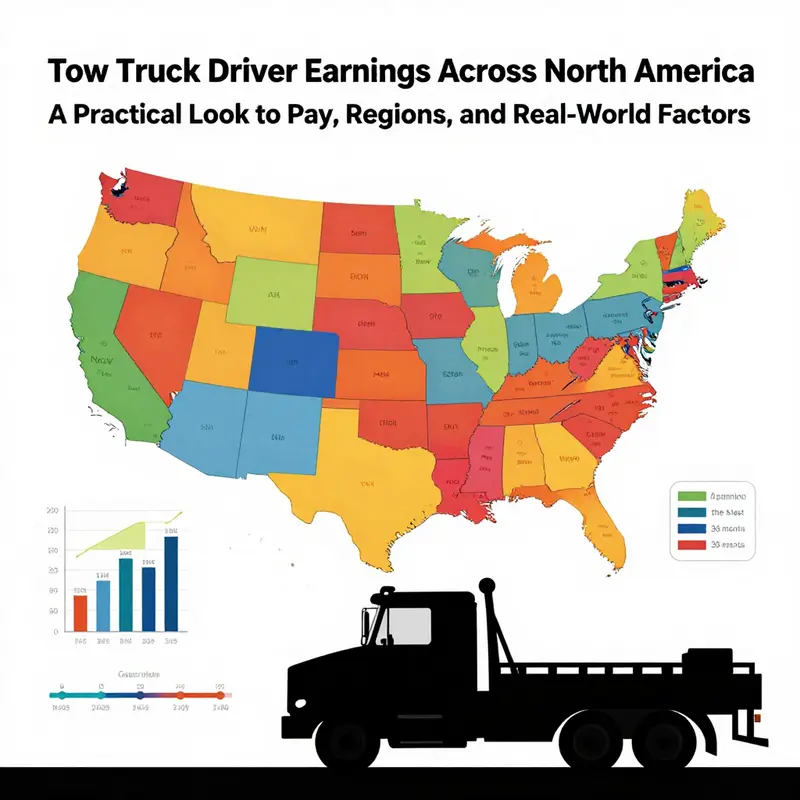

Regional differences matter. Pay tends to scale with cost of living, call volume, and roadside demand. Urban and high-demand markets push wages higher, especially for drivers on call after hours or in fleets that prize rapid response. Rural regions may see more modest hourly rates. Experience matters; seasoned drivers with a track record of safe and efficient service often command premiums. Employer type also matters: independents, small fleets, or large corporate fleets mix base pay, on-call pay, overtime eligibility, and benefits in distinct ways. The result is a layered compensation picture where the headline rate is only one component of total earnings.

The practical takeaway is to anchor expectations in up-to-date data while recognizing local variations. The baseline wage provides a solid starting point, but local market, job role, and employer philosophy will shape the final figure. Overtime opportunities, on-call stipends, shift differentials, and benefits can add meaningful value beyond the base wage. For readers evaluating this field, comparing regional trends and consulting state data helps map the local landscape. A quick snapshot is useful, but triangulating several credible sources yields the most actionable picture. External resources can supplement this understanding, but the essential view starts with the current nationwide data and local market analysis.

For readers who want to verify numbers, checking reputable salary sites and regional reports will provide up-to-date confirmation. The key is triangulation across sources to reflect local realities.

Chapter 2: Tow Truck Driver Earnings in the UK — Regional Variations, Experience, and What Shapes Pay

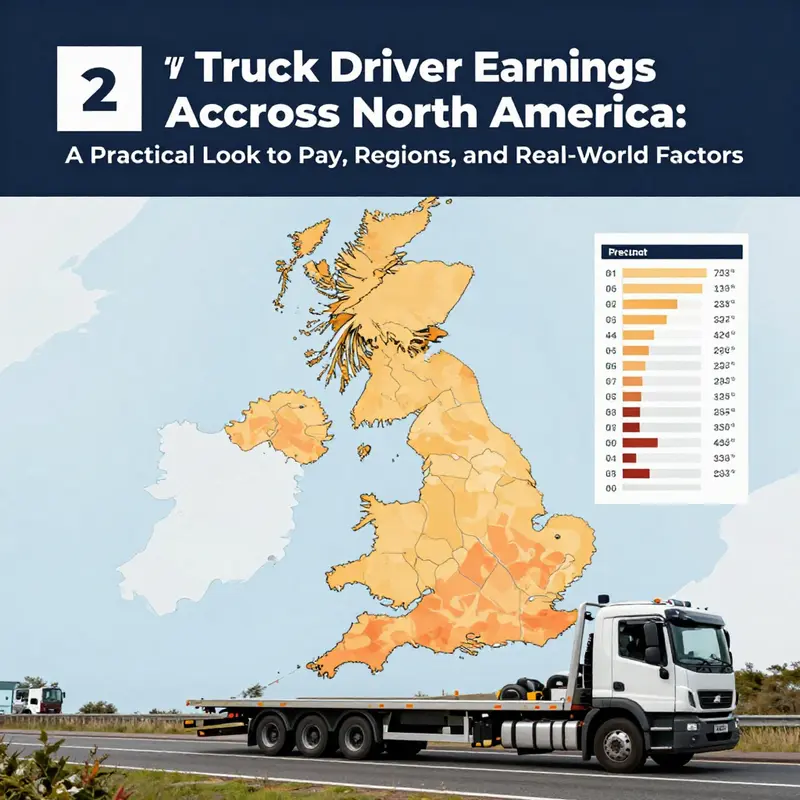

Across the United Kingdom, pay for tow truck drivers sits at a crossroads of geography, demand, and the immediacy of roadside need. The most recent English-focused figures place the average hourly wage around £13.14, a rate that emerges from a broad scan of wages across England. This figure is valuable as a baseline, but it conceals a landscape of pockets where pay climbs or falls depending on location, hours, and the specific towing work performed. In real terms, the pay envelope is not a single number but a spectrum shaped by regional markets, the policies of different employers, and the intensity of the work demanded during emergencies or busy periods. The job’s on-call nature means that evenings, nights, and weekend shifts often carry a premium in practice, even if the base rate remains constant from one employer to the next. For someone weighing the decision to enter or stay in this field, the English data suggest a solid entry point, but with clear potential to grow through experience and the right operating environment.

When you zoom in on regional variation, the picture becomes more concrete. East London, a dense urban area with high traffic pressures and a constant stream of incidents, shows an estimated hourly rate around £15.26. That difference of roughly £2 an hour compared with the national England average translates into meaningful incremental earnings for those who accumulate additional shift time, night calls, or weekend work. It also reflects the higher cost of living and the competitive labor market in metropolitan pockets where rapid-response reliability is essential. By contrast, Slough—a sizeable town near major transport corridors—appears among the higher-paying pockets within the region, underscoring how proximity to major routes, industrial activity, and demand cycles can push base pay upward. These pockets aren’t universal, but they illustrate how geography, for tow-truck work, translates directly into earning potential.

The broader UK context, even if not exhaustively mapped in the current English-focused data, points to several drivers of pay beyond the hourly base. The occupation spans emergency roadside recovery, long-distance towing, and on-site assistances that require different equipment, crew sizes, and response protocols. In practice, earnings hinge on more than the clock-in rate: they are shaped by the nature of the job, the vehicle and gear involved, and the incentives a firm uses to attract reliable drivers. Experience matters. A driver who has logged thousands of on-call hours and who has cultivated a steady flow of consistent assignments will often negotiate higher compensation, especially if their role includes predictable on-call coverage, overtime eligibility, or performance-based bonuses. Employer type also matters. Larger fleets with robust scheduling, better overtime structures, and formalized pay scales typically offer higher ceilings than smaller independents who may rely more on variable demand. The common thread is that remuneration responds to the blend of speed, reliability, and the ability to respond to incidents when they most urgently arise.

From a practical perspective, the base hourly figure is only one piece of the paycheck. A driver starting with an hourly rate around £13 could see modest weekly earnings if shifts are limited, yet the real-world income often rises with overtime and on-call premiums. A simple baseline—40 hours per week at £13.14—yields about £525 per week before tax, roughly £27,000 annually if the schedule remains steady. But many tow-truck roles include on-call stipends, overtime pay at premium rates, or distance-based allowances that compensate for travel to incidents outside the immediate locality. In high-demand locales or for drivers who regularly work nights and weekends, annual earnings can rise into the mid-£30,000s, reflecting not just longer hours but the value of consistent coverage during peak periods. The figures reveal a profession where earnings can accumulate through steady, predictable patterns as well as through bursts of overtime triggered by weather events, traffic accidents, or large-scale recoveries.

It is essential to approach these numbers with a clear understanding of what they represent. The English wage data capture a snapshot at a point in a wider, evolving labor market. They reflect averages that smooth out differences between urban cores and rural towns, between brand-new hires and seasoned veterans, and between the different kinds of towing work—from basic roadside assistance to complex recoveries on busy highways. They do not capture every possible scenario, such as regional variances across Scotland, Wales, or Northern Ireland, where pay levels may diverge due to local economies and demand conditions. They also do not fully reflect the potential upside from specialized certifications, safer-driver bonuses, or pay-for-performance schemes that some employers use to reward efficiency and safety records. In this sense, the UK landscape for tow-truck earnings is best understood as a baseline with ample room for upward movement through experience, task variety, and the willingness of drivers and firms to align compensation with real-world value.

For readers who want a more granular view of how earnings break down across different job types and duties, there is a concise internal resource that lays out the earnings framework in a structured way. See the detailed overview at tow-truck-driver-earnings. This resource helps illuminate how the base rate interacts with on-call pay, overtime, and regional adjustments, and it can serve as a practical guide for someone negotiating terms with an employer or planning a career path that emphasizes stability, growth, or a mix of both. The page also helps distinguish between the different kinds of towing work—emergency roadside response, long-haul towing, and stand-by services—and how each can influence the overall compensation package. By understanding the relationship between role type, hours, and location, workers can set realistic expectations and pursue opportunities that align with their financial goals.

Beyond the UK-specific discussion, it is useful to recognize that UK wages do not exist in isolation. International comparisons often highlight how local cost of living, regulatory frameworks, and labor market conditions shape what a tow-truck driver earns in a given country. For anyone weighing opportunities across regions or considering relocation to a higher-demand area, the main lesson remains consistent: proximity to major transport corridors, urban centers, and reliable on-call structures tends to elevate earning potential. The combination of experience, employer incentives, and the ability to work when demand is highest creates a career arc where early base rates can grow into substantial overall earnings, provided the driver develops the requisite skills, reliability, and safety record.

In sum, the United Kingdom presents a pay landscape where the baseline hourly wage sits in the modest to mid-range for a driving-oriented, on-call role. Yet the actual earnings for an individual driver can be notably higher or lower depending on where they work, how often they work overtime or back-to-back shifts, and how effectively they leverage experience to move into higher-paying niches or more stable schedules. For someone evaluating whether to enter the field or to relocate for better compensation, the core message is clear: regional variation matters, on-call demand matters, and the path to higher earnings is often paved by experience, reliability, and the strategic choice of employer and work type. External data sources offer a broader context for this picture, but the English wage snapshot provides a solid starting point for understanding how much tow truck drivers earn in the United Kingdom.

External resource: https://www.salaryexpert.com/tow-truck-driver-salary-in-england

null

null

Tow by the Numbers: Unraveling Pay Structures and Regional Earnings for Tow Truck Drivers

When people ask how much a tow truck driver earns, they are often surprised by how quickly a single number can lose its meaning. The core figure—a national average hourly rate—gives a snapshot, but pay in this field is a mosaic made from geography, experience, employer type, and the day-to-day realities of the job. Recent data from Indeed, updated in late 2025, place the United States’ average hourly wage for tow truck drivers at about $21.14, with an average weekly pay around $1,736. Those numbers sit near a national benchmark, yet they are barely more than a starting point. They tempt a reader to picture a uniform line on a chart, but the reality is a spectrum where the same job can feel very different from city to city and company to company. The same dataset notes a weekly range from roughly $840 at the low end to as high as $3,588, underscoring how much earnings hinge on factors beyond a base rate: overtime, on-call demands, job mix, and whether the work involves emergencies, heavy equipment, or hazardous conditions. These are not trivial differences, even if the base rate appears modest at first glance.

Geography remains a decisive driver of what a tow truck driver can expect to earn. In places with dense traffic, high living costs, and a steady tempo of roadside incidents, rates tend to climb. Metropolitan areas such as New York, Los Angeles, and Chicago embody this pattern. They pose greater operational complexity and risk, which is reflected in pay scales that compensate for a tougher commute, longer wait times in urban traffic, and a greater likelihood of high-stakes emergencies. In practical terms, a driver in a large urban market might command higher hourly rates or receive stronger incentives, even if the base wage is not dramatically higher than the national average. The job’s precarious timing—night shifts, weekends, and holidays—often translates into premium pay in the form of shift differentials, overtime, or on-call pay, which can push the total compensation well beyond the base hourly figure.

Beyond the base wage, most tow truck drivers accumulate additional earnings through a combination of overtime, on-call stipends, and performance-based incentives. Night shifts and weekend work frequently come with premium rates, and some employers offer bonuses tied to a number of completed calls or a weekly quota. The structure is practical: the volume of calls can peak during adverse weather, holiday travel, or major events, and drivers who can respond quickly and safely are increasingly rewarded for efficiency and reliability. There is also value in specialization. Drivers who operate heavy-duty tow trucks, cranes, or winches, or who hold certifications for hazardous materials handling, can command higher premiums. The premium pay is not simply a line item; it can shift a driver’s experience from a solid part-time to a robust full-time income.

But it would be incomplete to discuss pay without acknowledging the broader framework in which a tow truck driver’s earnings grow. The job’s pay structure is deeply shaped by the employer type—private towing companies, long-haul or municipal fleets, roadside assistance networks, and on-call dispatch services all present subtly different compensation packages. A private towing company might emphasize per-call pay combined with overtime, while a municipal fleet might lean more toward stable base wages with structured benefits. In addition, the demand curve for towing services—often tied to weather, traffic patterns, and regional road infrastructure—can alter how lucrative a given market feels across the calendar year. For someone evaluating where to work, this means looking beyond the hourly rate to the full compensation ecology: how much overtime is realistically available, whether shift differentials push the effective hourly rate higher, and what kind of bonuses or incentives are tied to performance.

To illustrate the global breadth of this field, the North American context also includes nuanced Canadian numbers. In Canada, the nationwide average hourly wage for tow truck drivers sits around CAD 17.75, based on monthly salary data through early 2026. The dispersion mirrors the United States: major urban centers like Toronto and Vancouver tend to offer higher wages due to demand and competition among specialized towing firms, while smaller towns or provinces with fewer dispatch hubs may lean toward the lower end of the scale. Several Canadian employers illustrate the upper end of the spectrum with tangible figures: for instance, a company operating a sizeable fleet in Ontario reported annual earnings around CAD 71,318 for certain roles, which translates to roughly CAD 36 per hour when you factor in overtime and on-call pay. Other operators list annual ranges from CAD 50,000 to CAD 80,000 for mid-career drivers, and in some cases CAD 36 per hour as a baseline with additional on-call or shift pay. In Dieppe, New Brunswick, for example, hourly wages tend to range from CAD 18 to CAD 25, depending on experience and the specific roster. Some sources discuss higher annual figures—up to six-figure territory—likely reflecting senior positions, specialized duties, or a combination of long hours, overtime, and regional pay practices. Taken together, the Canadian picture reinforces the same core insight as the U.S. data: base pay is influenced by location and job mix, while total earnings reflect the tally of overtime, special assignments, and dispatch-driven incentives.

A driver’s income, then, is not a single number but a function of many interlocking variables. Experience matters: veteran drivers with a reliable track record, calm handling of high-pressure calls, and a history of safe vehicle operation tend to command better shift assignment and might receive referrals that boost hours and earnings. The risk profile of the work—whether it involves storm response, roadside emergency rescue, or the transport of heavy equipment—can also shift pay bands. The practical takeaway is straightforward: if you are evaluating this career path, you should consider not only the posted hourly wage but also the likelihood of overtime, the potential for on-call shifts, the regional cost of living, and the structure of bonuses or incentive programs that reward volume and efficiency. In other words, the total earnings picture emerges when you add the base pay to the band of add-on incomes that vary with time, geography, and company policy.

For readers seeking a consolidated view of these dynamics, there is value in looking at credible salary aggregators that compile thousands of job postings and actual pay records. In addition to national datasets, a look at the regional and company-specific trends can reveal how much a driver might take home during a busy season or in a high-demand market. One practical way to explore this is to examine established wage data and to cross-check with regional job postings that show the tempo of call volume and the availability of overtime and night premiums. Quick references to national data, regional variations, and the added value of on-call pay can help a prospective driver map a realistic income path over a career. For those who want a first-hand sense of the range of possibilities in this field, there is a useful internal resource that gathers pay information across the spectrum of tow-truck roles. It provides a snapshot of earnings and the components that lift total pay beyond the baseline hourly rate: Tow Truck Driver Earnings. This resource helps ground the numbers in practical expectations, particularly for readers weighing part-time versus full-time commitments, or those considering moves between private, municipal, and emergency-response fleets.

Beyond the immediate North American market, the pay story for tow truck drivers aligns with broader labor-market patterns: roles with irregular hours, exposure to environmental risks, and a premium on quick, reliable service tend to reward those factors with higher effective pay through overtime, call-out bonuses, and shift differentials. The job’s physical demands and the responsibility of safety further reinforce the premium for experience and reliability. As a result, the arithmetic of earnings is as much about the predictability of income as it is about the hourly rate. A driver who can secure consistent dispatches, maintain a fleet of reliable partners, and sustain performance across high-pressure shifts is more likely to see a robust total compensation package that exceeds what the base wage would indicate. The chapter’s aim is not to pin down a single figure but to illuminate how to read the pay landscape: weigh the base wage alongside overtime, on-call pay, and region-specific allowances; look for specialization that can unlock premium pay; and recognize the role of market demand in shaping the premium you can negotiate.

For readers who want a broader external perspective, resources such as Glassdoor’s salary data can offer additional context on employer variability and satisfaction drivers that accompany earnings. See the external resource for a broader view of what tow-truck drivers report about pay in various markets: https://www.glassdoor.com/Salaries/tow-truck-driver-salary-SRCH_KO0,13.htm.

Tow Truck Driver Earnings Unveiled: What Moves Pay, and Why Location, Hours, and Roles Matter

Tow truck driver earnings are rarely a single headline number. They emerge from a tangle of variables—where you work, how much you work, the nature of the shifts, and the specific duties you perform. When you step back and map these factors across the North American landscape, a coherent picture begins to form: pay is a function of geography, time on the clock, and the complexity of the job, all mediated by the type of employer and the breakneck pace of roadside demands. The latest data from Indeed shows the United States delivering an average hourly wage in the low twenty dollars, with weekly earnings that can hover around the mid-thirties to mid-forties when overtime and on-call duties are included. On the surface, those numbers look clean, but they mask a broad spectrum. A driver in a busy urban corridor can see both higher hourly rates and a more intense workload than someone stationed along quieter highways in smaller towns. The typical range often sits between roughly the high teens to mid-twenties per hour, yet the top end in major markets can push beyond that baseline, especially for specialized roles or after accumulating several years of on-the-job experience. A weekly reality check mirrors that shape: the lower end could rest around a few hundred dollars, while those fully engaged in emergency and roadside rescue may reach higher figures when shifts are long and demand is unrelenting. The Canadian scene echoes the same logic but with its own regional contours. The country’s wage map points to a conspicuous split: the western provinces, particularly British Columbia, tend to offer higher hourly rates on full-time postings, driven by urban demand, cost of living, and the premium on urgent response capabilities. Alberta’s numbers show a lower provincial average, yet professional, full-time positions can reach well into the upper teens per hour and, in some employers, approach or exceed the mid-30s. In British Columbia, several frontline postings advertise hourly wages in the high thirties in certain zones, and monthly take-home can stretch into the four- to eight-thousand-dollar range for full-time roles depending on overtime, shifts, and coverage needs. In short, while the headline averages provide a quick orientation, the real pay story unfolds when you factor in overtime, on-call time, region, and the work type—transport, roadside assistance, or urgent rescue along busy corridors. The broader lesson is simple: geography matters, and so does the structure of the job itself. For readers seeking a concrete entry into this layered picture, a focused breakdown of earnings by category is available here: tow truck driver earnings.

Location remains the most visible dial in the pay equation. Urban centers with dense traffic, high accident rates, and a constant churn of service requests naturally generate more hours and more opportunities to earn. This is amplified for drivers operating during peak times, nights, weekends, or holidays, when demand spikes and dispatch centers stretch to cover every call. Conversely, rural postings can offer steadier hours but fewer opportunities to push earnings upward through overtime or specialized duties. The logistical reality of covering highways, interchange ramps, and service this or that town creates a rhythm unique to each market. High-demand regions also tend to feature tighter competition for skilled drivers, which can lift starting wages and the pool of available overtime. The other side of the coin is the degree of risk and responsibility that accompanies certain shifts. Emergency or high-priority rescue tasks, such as those on crowded interstates during inclement weather, can command higher overtime rates and occasional shift differentials, reflecting the complexity and urgency of the work.

Overtime and shift patterns sit at the heart of the earnings story. Tow truck work is a field built on coverage—covering nights, weekends, and holidays because incidents do not observe a clock. The typical model features rotating or fixed shifts that may stretch to ten hours or more, with on-call periods that can extend the effective workweek beyond the standard 40 hours. Overtime pay is a major lever, and many employers apply a rate premium that reflects the extra time spent on the road, the unpredictable nature of roadside emergencies, and the wear and tear on equipment. In practice, a driver who leans into longer shifts or more frequent on-call windows can see meaningful bumps to weekly income, especially when overtime policies stack with high-demand periods. Labor rules in some jurisdictions reinforce this dynamic, prescribing higher pay for hours that exceed the standard daily limit, and in Canada, labor laws commonly kick in after a threshold that mandates additional compensation. The upshot is practical: the hour you choose to work, and the calls you answer, can move pay by a sizable margin without changing the base hourly rate alone.

Benefits form the other side of the compensation coin. Beyond base pay and overtime, many employers bundle packages that ease the financial strain of the job. A typical benefits suite can include health coverage that addresses medical, dental, and vision needs, paid time off to handle personal or health matters, and retirement or savings plans that match or contribute to a driver’s long-term security. For those who rely on a company vehicle or partial equipment subsidies, the value of non-wage compensation can be substantial, especially when annual maintenance, training, and safety certification are factored in. Training itself is a meaningful investment in a driver’s career. Initial orientation often includes safety protocols, vehicle operation standards, and on-the-job check procedures. Ongoing education in defensive driving, hazardous material handling, or load securement becomes a differentiator for mastery and career advancement. In this sense, the job’s benefits extend beyond the wallet—creating a pathway toward higher responsibility, improved safety outcomes, and more stable employment relationships.

Industry roles and responsibilities also shape the earnings landscape. The classic tow truck driver handles roadside assistance, towing a malfunctioning vehicle to a repair shop or another designated location. Yet the field includes a spectrum of roles that influence pay and workflow. A flatbed or heavy-duty operator, for instance, commands different premiums based on vehicle type, terrain, and required equipment. Some drivers combine mechanical skills with towing duties, adding value through on-site diagnostics or minor repair work, which can unlock additional earning avenues and reduce downtime for customers. There are specialized niches as well—drivers trained for high-risk road conditions, extreme weather responses, or complex recoveries—where the skill set, training requirements, and risk exposure align with higher compensation. The ethical core of the job—responding quickly, ensuring safety for the public, and coordinating with insurers, authorities, and dispatch teams—remains consistent across these roles, but the concrete tasks, tools, and call volume shift the earning potential.

Workplace culture and job satisfaction, while not direct pay levers, still influence how much a driver ultimately takes home. A well-regarded employer culture that emphasizes safety, clear communication, and fair scheduling can translate into lower turnover and steadier hours. Conversely, noisy or disorganized environments can erode morale and reduce the effective value of even a higher hourly rate. When evaluating opportunities, it helps to weigh how a company manages scheduling, claims processing, and on-call expectations. The same Indeed data that outlines the broad pay spectrum also reminds readers that the experience of work varies across organizations. Prospective drivers are wise to seek workplaces that provide constructive leadership and a predictable cadence, reducing the friction that can otherwise dampen earnings potential over time. In this sense, the value of a job in tow services is not only in the money it pays but also in the structure and support that sustain reliable, safe, and ongoing work.

Taken together, the North American earnings picture for tow truck drivers is best understood as a spectrum rather than a single line. At the base, you have a common hourly window that reflects local markets and employer type. On top of that, overtime and on-call time can push weekly earnings into significantly higher territory, especially in busy urban centers or during peak demand periods. Add the value of benefits and training, and the overall compensation package often surpasses what base pay alone would suggest. Across Canada, the same logic holds, with Western coastal markets frequently offering the highest immediate pay for full-time roles and strong monthly take-home when overtime and on-call incentives are included. The macro takeaway is clear: if pay is your primary lens, you should map out the markets where you intend to work, identify the shift patterns that match your lifestyle, and pursue roles that align with your willingness to train and handle the higher responsibilities that come with advanced or specialized towing tasks. For a focused breakdown of earnings by category, consider the dedicated resource on tow truck driver earnings, which provides a clearer, role-based lens for readers seeking to compare regions and job types.

External reading you may find useful can be found at an authoritative salary database that aggregates real-world postings and reports. This resource offers a concrete benchmark for those aiming to benchmark themselves against peers across the country and across the spectrum of tow-related work.

Note: the internal link provided above directs readers to a detailed, role-oriented breakdown of earnings that complements the broader discussion here. It is intended to help readers connect the dots between regional trends, shift structures, and the real-world payoff of different tow-related roles. The external source listed below completes the picture with a widely used, official payroll snapshot for the United States, giving readers a dependable reference point as they weigh career options and negotiate compensation.

External resource for further reading: https://www.indeed.com/salaries/tow-truck-driver-salary

Final thoughts

Across regions, tow truck driver earnings reflect more than a flat hourly rate. While the United States shows a healthy average weekly income in the mid-$1,700s, regional gaps, overtime opportunities, and employer types can significantly expand or constrain total compensation. The United Kingdom presents a mosaic of regional pay patterns where public, private, and contractor models influence take-home pay, and Canada demonstrates how urban demand and company culture—plus on-call duties and overtime—drive hourly rates higher in key markets. The pay structure itself matters too: base hourly rates, overtime eligibility, on-call pay, night shifts, and incentive programs all contribute to the final paycheck. For Everyday Drivers, residents, and commuters, understanding these dynamics helps set realistic expectations when hiring, budgeting, or planning for vehicle-related services. For truck owners, auto shops, dealerships, and property managers, it informs staffing decisions, service pricing, and workforce planning. The common thread is clarity: regional context, job type, and the scope of duties shape earnings just as much as raw hourly rates. With this lens, stakeholders can tailor compensation strategies that align with local demand, operational realities, and the level of service customers expect.